Land of Opportunity: Unveiling the Secrets of Indian Reservation Loans

Land of Opportunity: Unveiling the Secrets of Indian Reservation Loans

The United States has a complex and often misunderstood relationship with its Native American communities. While progress has been made in recent years, many reservations face significant challenges, including limited economic opportunities. One way to address these challenges is through access to capital. Enter Indian Reservation Loans, a powerful tool that can help Native American communities thrive.

But what exactly are Indian Reservation Loans? And how can they benefit tribal members and communities? Let’s dive in and explore this unique lending landscape.

Related Articles: Land of Opportunity: Unveiling the Secrets of Indian Reservation Loans

Understanding the Basics: What are Indian Reservation Loans?

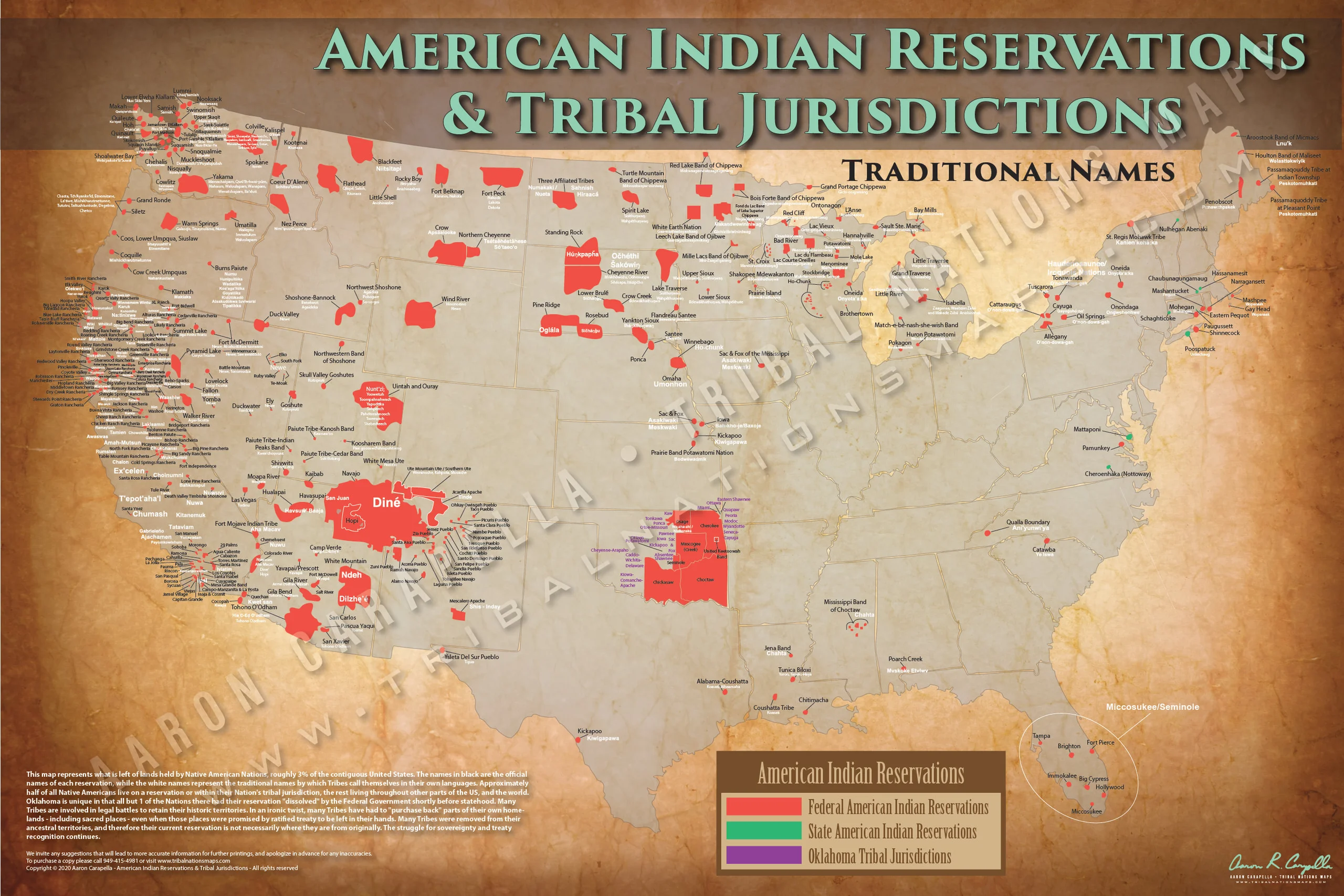

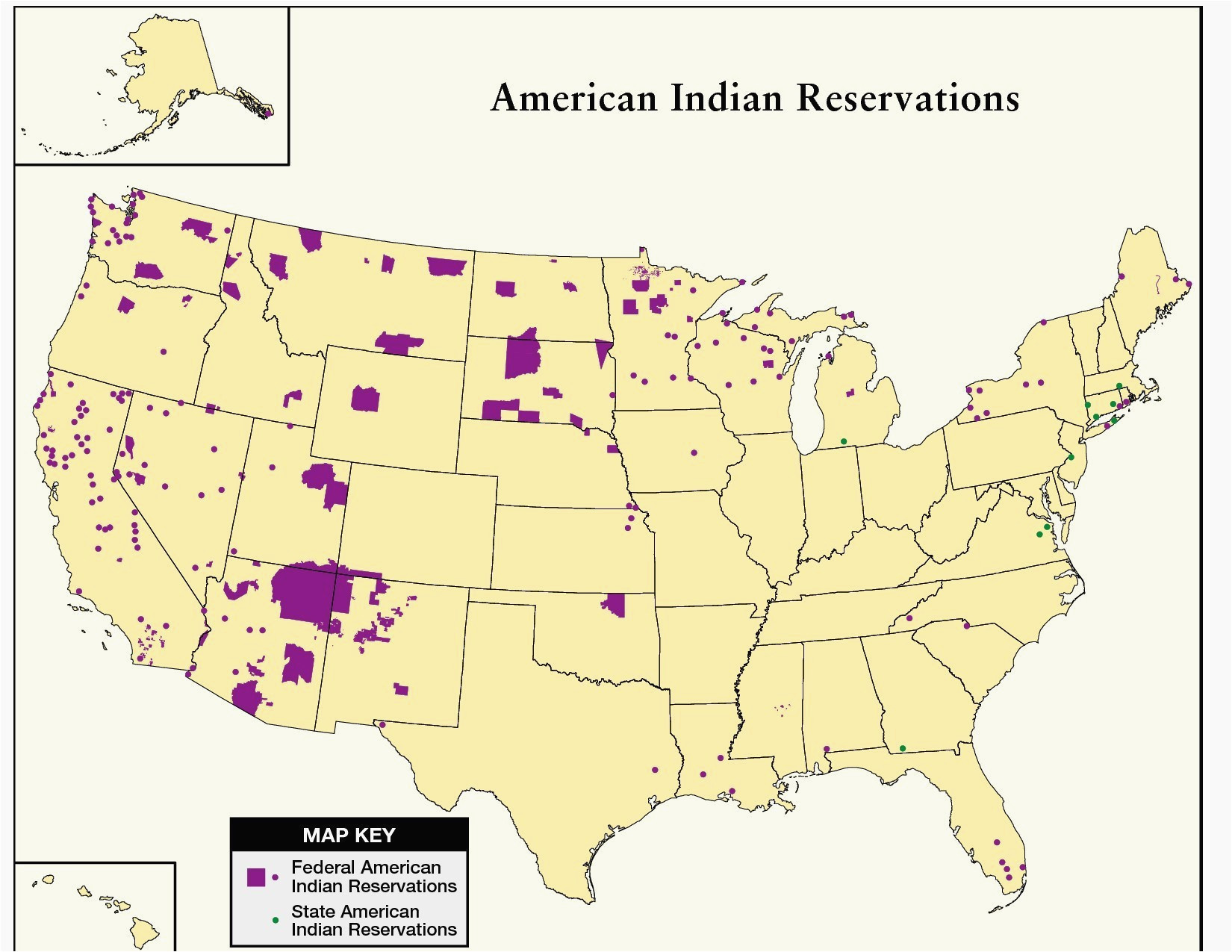

Indian Reservation Loans are a specific type of financing available to individuals and businesses located on federally recognized Indian reservations. These loans are designed to support economic development on reservations, promoting self-sufficiency and fostering a stronger economic future for Native American communities.

Who is Eligible for Indian Reservation Loans?

Eligibility for Indian Reservation Loans depends on a few key factors:

- Tribal Membership: You must be a member of a federally recognized tribe.

- Location: Your business or residence must be located on a federally recognized Indian reservation.

- Creditworthiness: Like any loan, you’ll need to demonstrate a good credit history and the ability to repay the loan.

Types of Indian Reservation Loans:

There are various types of loans available, each tailored to specific needs:

- Business Loans: These loans can help Native American entrepreneurs launch, expand, or improve their businesses. They can be used for working capital, equipment purchases, or even building construction.

- Housing Loans: These loans provide financing for the purchase, construction, or rehabilitation of homes on reservations.

- Community Development Loans: These loans support projects that benefit the entire community, such as infrastructure improvements, healthcare facilities, or educational programs.

Where Can I Find Indian Reservation Loans?

Several sources offer Indian Reservation Loans:

- Tribal Lending Institutions: Many tribes have their own lending institutions, often providing more flexible terms and lower interest rates than traditional lenders.

- Federal Agencies: The U.S. Department of Housing and Urban Development (HUD) and the U.S. Department of Agriculture (USDA) offer programs that support economic development on reservations.

- Private Lenders: Some private lenders specialize in providing loans to Native American businesses and individuals.

Advantages of Indian Reservation Loans:

- Lower Interest Rates: Often, Indian Reservation Loans come with lower interest rates than traditional loans, making them more affordable.

- Flexible Terms: Many lenders offer flexible repayment terms to accommodate the unique needs of Native American communities.

- Economic Development Focus: These loans are designed to promote economic growth on reservations, creating jobs and improving the quality of life for tribal members.

The Importance of Tribal Self-Determination:

One of the key benefits of Indian Reservation Loans is their ability to empower Native American communities. These loans allow tribes to control their own economic destiny, making decisions that are in the best interests of their members.

Navigating the Lending Landscape: Tips for Success:

- Research Your Options: Don’t just settle for the first lender you find. Compare interest rates, terms, and fees from various sources.

- Build a Strong Credit History: A good credit score will increase your chances of getting approved for a loan and securing favorable terms.

- Develop a Solid Business Plan: If you’re applying for a business loan, a well-written business plan will demonstrate your commitment and increase your chances of getting funding.

- Seek Guidance: Many tribes have economic development departments that can provide advice and resources for obtaining loans. Don’t be afraid to ask for help!

The Road Ahead: Opportunities for Growth and Empowerment

Indian Reservation Loans are not just about money; they’re about opportunity. They’re about empowering Native American communities to build a brighter future for themselves and future generations. By fostering economic development, these loans can help address historical injustices and create a more equitable society for all.

FAQ: Indian Reservation Loans

Q: What is the maximum amount I can borrow with an Indian Reservation Loan?

A: The maximum loan amount varies depending on the lender and the purpose of the loan. It’s best to contact the lender directly to discuss your specific needs.

Q: What are the typical interest rates for Indian Reservation Loans?

A: Interest rates can vary, but they are often lower than traditional loans. It’s important to compare rates from multiple lenders to find the best deal.

Q: How long does it take to get approved for an Indian Reservation Loan?

A: The approval process can vary depending on the lender and the complexity of the loan. It’s a good idea to start the application process early to allow enough time for review.

Q: What are the repayment terms for Indian Reservation Loans?

A: Repayment terms can vary, but they are often flexible to accommodate the needs of the borrower. It’s important to discuss repayment terms with the lender before signing any loan documents.

Q: Where can I find more information about Indian Reservation Loans?

A: You can contact your tribe’s economic development department or the U.S. Department of Housing and Urban Development (HUD) for more information.

Conclusion: A Legacy of Opportunity

Indian Reservation Loans represent a vital opportunity for Native American communities to achieve economic self-sufficiency. By providing access to capital, these loans empower tribes to invest in their future, create jobs, and build stronger, more resilient communities. As we move forward, it’s essential to continue supporting these programs and ensure that Native American communities have the resources they need to thrive.

Closure

Thus, we hope this article has provided valuable insights into Land of Opportunity: Unveiling the Secrets of Indian Reservation Loans. We appreciate your attention to our article. See you in our next article!